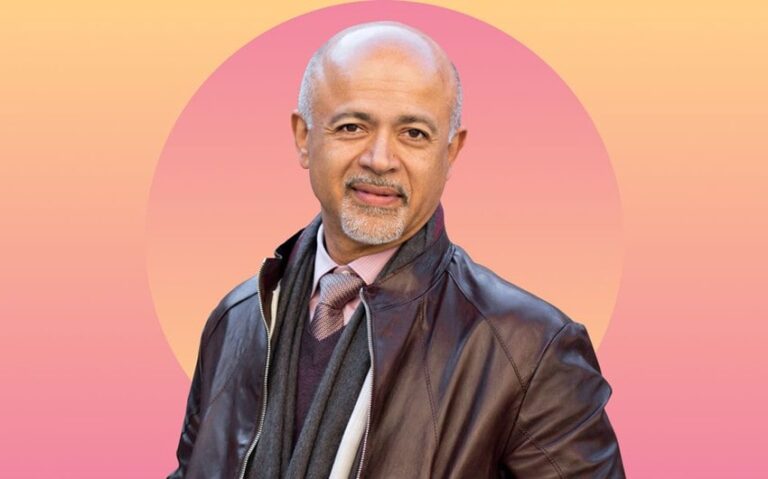

Michael Iavarone’s Net Worth in 2025: Racing Wins and Financial Returns

If you’ve ever followed the Kentucky Derby or the high-stakes world of horse racing syndicates, you’ve probably wondered about Michael Iavarone’s net worth. His story isn’t a simple one—it’s a blend of Wall Street instincts, record-breaking wins, public controversies, and a comeback that has kept him in the spotlight for decades. In 2025, Iavarone stands as both a seasoned investor and a horse racing figure with a legacy defined by his part-ownership of Big Brown, the horse that captured the nation’s attention.

From Wall Street to the Winner’s Circle

Michael Iavarone didn’t start his career in the stables—he started in the financial markets. As a young trader in the penny-stock sector, he learned quickly how to navigate risk and spot opportunities others overlooked. His early years in finance weren’t without controversy; the penny-stock world is notoriously volatile and scrutinized. But those experiences honed his appetite for high-reward ventures, something that would carry over into his next chapter.

In the mid-2000s, Iavarone co-founded IEAH Stables, a horse racing investment group that mirrored the structure of hedge funds and private equity firms. Instead of pooling capital for stocks or commodities, IEAH pooled investor money to buy, train, and race top-tier thoroughbreds. This innovative approach changed the way many people thought about ownership in the sport. Iavarone applied a Wall Street mindset to the track, focusing on returns, syndication, and portfolio diversification—except his “assets” were living, breathing athletes.

The gamble paid off spectacularly in 2008 when IEAH’s star colt, Big Brown, won both the Kentucky Derby and the Preakness Stakes. Suddenly, Iavarone wasn’t just a finance guy dabbling in racing—he was the co-owner of one of the most famous racehorses of the decade.

Estimating His Net Worth—How Much Is Michael Iavarone Really Worth?

Pinning down Michael Iavarone’s net worth is challenging because his wealth comes from both private investment activity and public prize winnings, and those numbers aren’t always fully disclosed. Public reports and interviews put his net worth anywhere from $10 million to $25 million, with many estimates clustering around the $20 million mark. Variations in these figures depend on whether they include the value of his real estate, private holdings, and any unpublicized investment stakes.

The reality is that Iavarone’s financial picture has changed significantly over the years. The peak years of IEAH brought in millions from race purses, stud fees, and horse sales. However, the collapse of the syndicate after Big Brown’s career ended, coupled with legal disputes and business restructuring, likely reduced his liquidity for a time. Even so, his continued presence in horse ownership and investing—plus his ability to stage a comeback—points to a solid financial foundation that has endured market and industry shifts.

Financial Playbook—Where His Wealth Comes From

Racing Payouts & Big Brown Windfall

The crown jewel of Iavarone’s racing career is undoubtedly Big Brown. As part-owner, Iavarone benefited directly from the horse’s winnings, which totaled roughly $3.5 million during his career. Ownership shares vary depending on syndicate agreements, but a 40% stake in those winnings would translate to well over a million dollars. Beyond race purses, Big Brown’s breeding rights added another substantial revenue stream. Stallion services for a Derby winner can command six-figure fees, and over the course of a breeding career, those earnings can surpass race-day payouts.

IEAH’s racing portfolio at its peak included multiple graded stakes winners, meaning Iavarone’s share of winnings extended beyond just Big Brown. The business model was aggressive: buy promising horses, race them at the highest level, and cash in on both performance and resale value.

Wall Street & Investment Income

Before and alongside his racing ventures, Iavarone’s investment career provided a steady source of income. His work in asset management and securities trading, while not as publicly documented as his horse racing exploits, formed the base capital that allowed him to take big swings in the sport. Investment experience also gave him the tools to diversify his wealth, likely into areas such as equities, private businesses, and possibly real estate.

The mindset he carried over from finance—assessing ROI, managing investor expectations, and handling portfolio volatility—helped him navigate the ups and downs of racing ownership. It also meant that even when his stable’s fortunes dipped, he had the skills and network to rebuild.

Media, Assets & Lifestyle Value

Michael Iavarone’s profile grew beyond the racing world when he and his wife, Jules, were featured in media coverage and documentaries, including appearances related to the Netflix series Race for the Crown. While media exposure doesn’t necessarily equate to massive direct income, it reinforces personal branding, which can be leveraged for partnerships, sponsorships, or speaking engagements.

His lifestyle also offers clues to his financial standing. Reports have placed him among owners of luxury real estate, private jets, and yachts—assets that are not only symbols of wealth but can also be leveraged or sold when needed. His notable win in 2020 of $435,029 from a Pick-5 horse betting ticket further demonstrates his ongoing involvement in and mastery of the sport’s wagering side. For a seasoned player like Iavarone, even personal betting can represent a meaningful boost to annual income.

Setbacks & Redemption—How Challenges Shaped His Finances

The IEAH success story was not without turbulence. Following Big Brown’s retirement, the stable faced a series of challenges: declining results from new acquisitions, internal disputes, and the broader economic downturn that tightened investor spending in horse racing. Some of Iavarone’s business partners faced legal troubles, which added reputational risk and financial strain to the operation.

Despite these setbacks, Iavarone managed to stage a comeback. He shifted away from large syndicates and embraced a more personal ownership model, often partnering with his wife Jules. This more streamlined approach allowed for greater control over expenses, horse selection, and race strategy. It also insulated him from some of the pressures and liabilities of running a large investment-backed stable.

This ability to adapt—to shrink the scale of operations while maintaining a presence in elite racing—speaks to the financial acumen he honed long before he ever bought his first thoroughbred. By focusing on quality over quantity, Iavarone positioned himself to stay relevant in a sport that can be brutally unforgiving to even the wealthiest participants.

Featured Image Source: thoroughbreddailynews.com