What Is Martin Armstrong’s Net Worth and How He Built His Financial Empire

When people ask, “What is Martin Armstrong’s net worth?”, they’re usually referring to one of the most controversial and brilliant figures in modern finance. Armstrong, an American economist, forecaster, and former hedge fund manager, is best known for developing the Economic Confidence Model, a mathematical theory that predicts economic turning points using cycles of time. His story is a fascinating mix of genius, controversy, and redemption—from building one of the world’s most respected forecasting firms to serving time in prison and later reemerging as a sought-after economic voice.

As of 2025, Martin Armstrong’s net worth is estimated to be around $5 million to $15 million, though the exact figure is difficult to verify due to his complex financial history and past legal battles. His wealth has fluctuated dramatically over the decades—at one point he controlled billions in assets through his company Princeton Economics International, before losing much of it amid fraud allegations and government seizures. Today, Armstrong continues to earn from consulting, writing, and public speaking engagements, maintaining influence in global financial circles.

Early Life and Education

Martin Arthur Armstrong was born on November 1, 1949, in New Jersey, USA. From an early age, he displayed a strong interest in numbers, history, and the patterns that connect human behavior to economic events. He began collecting coins as a teenager, which sparked his fascination with economic cycles and the flow of money over time.

Although Armstrong did not follow the traditional academic path of many economists, he built his expertise through self-education and real-world experience. By his early 20s, he had already established himself as an authority in the rare-coin and investment markets. His ability to recognize long-term economic trends through historical data would later shape his life’s work.

The Rise of Princeton Economics International

In the late 1970s and early 1980s, Martin Armstrong founded Princeton Economics International, Ltd., a company that specialized in economic forecasting and investment advisory services. Using his proprietary models and deep understanding of global markets, Armstrong’s firm quickly gained a reputation for astonishingly accurate predictions.

His Economic Confidence Model, based on a repeating 8.6-year cycle (or approximately 3,141 days, correlating with the mathematical constant π), became legendary among investors. Armstrong claimed the model could forecast major turning points in economies and financial markets worldwide.

Some of his early successes included:

- Predicting the 1987 stock market crash months before it happened.

- Accurately forecasting the collapse of the Soviet Union.

- Warning of the Asian financial crisis of 1997, which devastated emerging markets.

These predictions earned Armstrong a global following. Major corporations, central banks, and even governments sought his guidance. At his peak, Princeton Economics reportedly managed billions of dollars in assets, and Armstrong’s personal net worth was rumored to be in the hundreds of millions.

The Fall: Legal Troubles and Imprisonment

Despite his financial success, Armstrong’s empire began to unravel in the late 1990s. In 1999, the U.S. government charged him with fraud, alleging that he had defrauded investors of nearly $3 billion through unauthorized transactions involving Japanese investors and bank accounts. Armstrong denied the charges, claiming he was being scapegoated by corrupt officials and powerful financial interests.

In 2000, Armstrong was found in contempt of court for failing to turn over assets to authorities and was imprisoned for seven years without formal conviction—one of the longest such cases in U.S. legal history. In 2007, he pleaded guilty to one count of conspiracy to commit fraud, was sentenced to five years, and was released in 2011 after serving nearly 11 years in prison.

During his incarceration, Armstrong continued to write and refine his economic theories, producing essays and forecasts that were later compiled into books and films. His writings during that period solidified his image as both a persecuted truth-teller and a brilliant, if controversial, mind.

Return to Public Life and Renewed Influence

Following his release, Armstrong resumed his economic work through Armstrong Economics, his new platform dedicated to market analysis, forecasts, and educational content. His Economic Confidence Model continued to attract attention for its accuracy in predicting key global events, including the 2008 financial crisis, Brexit, and shifts in U.S. political cycles.

In 2014, Armstrong’s life story was dramatized in the German film The Forecaster, which portrayed him as a visionary economist targeted by the government and major banks. The film reignited public interest in his theories and contributed to his growing following among financial thinkers, crypto investors, and political analysts.

Armstrong now runs ArmstrongEconomics.com, where he publishes daily analyses and hosts the World Economic Conferences (WEC), annual events attended by investors, policymakers, and academics worldwide.

Martin Armstrong’s Net Worth and Current Earnings

Determining Martin Armstrong’s current net worth is challenging due to the opaque nature of his business dealings and the aftermath of his legal troubles. However, his present income sources include:

1. Consulting and Forecasting Services

Armstrong provides private consulting for investors and institutions who rely on his models to navigate volatile markets. His insights are sought after in both traditional finance and the emerging cryptocurrency sector.

2. Books and Media

He has published several books, including The Cycle of War and the Coronavirus (2020), Manipulating the World Economy (2019), and The Greatest Bull Market in History (2021). These publications contribute to his revenue through royalties and speaking tours.

3. Conferences and Speaking Engagements

Armstrong’s World Economic Conferences attract high-paying attendees from around the world. Tickets can cost thousands of dollars, and the events help fund his continued research and public outreach.

4. Online Platform and Subscriptions

His website and subscription-based services provide premium content, including market reports and private forecasts. This recurring revenue model supports his business and personal finances.

Taken together, these sources place Martin Armstrong’s net worth between $5 million and $15 million, though his influence in global economic circles arguably outweighs his financial holdings.

The Economic Confidence Model and Its Legacy

One of Armstrong’s lasting contributions to financial theory is his Economic Confidence Model (ECM). Based on the idea that human behavior in markets follows cyclical patterns, the ECM proposes that major economic shifts occur every 8.6 years. Armstrong’s model is expressed through the mathematical constant π (Pi = 3.141), which he claims governs both natural and economic cycles.

While many mainstream economists dismiss his theories as unconventional, his accurate forecasts of key turning points in global markets continue to generate intrigue and respect—even among skeptics.

Personal Life and Character

Armstrong has kept his personal life relatively private. He has children but largely avoids discussing his family publicly, preferring to focus on economics and policy. Despite his past, Armstrong’s resilience and unwavering belief in his theories have defined his later years.

He’s known for his outspoken criticism of government overreach, financial corruption, and central banking policies. His followers regard him as a truth-teller unafraid to challenge authority—a reputation that has only grown since his imprisonment.

Final Thoughts on Martin Armstrong’s Net Worth

So, what is Martin Armstrong’s net worth truly about? Beyond the estimated $5–15 million figure lies a story of brilliance, risk, and redemption. Armstrong’s wealth has waxed and waned dramatically, reflecting both the rewards and perils of operating at the highest levels of global finance.

From billionaire clients and predictive success to imprisonment and public scrutiny, Armstrong’s life mirrors the cyclical patterns he has spent decades studying. Today, his financial legacy rests not only in his personal wealth but also in his enduring impact on economic theory and forecasting.

Whether you view him as a misunderstood genius or a controversial figure, Martin Armstrong’s journey proves that intellectual capital can be as valuable—and volatile—as financial capital itself.

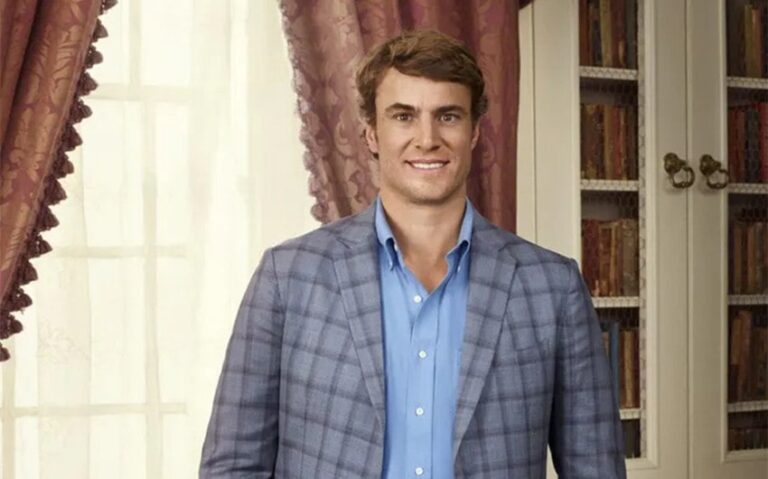

Featured image source: shelfd.com